SMEs around the world are facing intensive challenges in financing, including high thresholds to gain access to capital and high cost of financing. The Chinese government has been highly focused on how finance can help SME development and has launches several policies to support the development of financial tools for SMEs. Sunshine Research Center for Financial Innovation, THUIFR conducted exclusive research into this question in 2018. It is found that credit discrimination was a core problem facing SMEs and it introduced a new online supply chain financing model, “Daokoudai”, to solve this problem. Insights from the original report, published on December 10, 2018, are explained below.

Credit discrimination

Credit discrimination refers to a situation that SMEs are unable to obtain enough credit from banks due to the lack of fixed assets under the current credit system in China. Most banks and financial institutions offer loans to SMEs through the mortgage guarantee scheme method. This results in credit discrimination and increased of cost in financing for SMEs.

The main reasons of credit discrimination arise from:

Under-collateralization of SMEs. Financial institutions would more prefer large enterprises or state-owned enterprises when offering credit.

Financial institution concern about SMEs role in excess capacity, employment issues and lack of technology upgrading and tend to evaluate SMEs as inherently risky.

The information asymmetry between banks and SMEs brings more default risks for SMEs.

Lacking of use of financial technology in business also leads to problems for lenders in accessing accurate and timely information from SMEs.

The new financing model ‘Daokoudai’

Daokoudai, an online supply chain financing platform, was established in 2014 by the Fintech Lab, THUIFR with the aim of solving financing problems for SMEs. Daokoudai has created a new SMEs financing model based on receivables. As of September 2018, Daokoudai has offered over 10 million RMB for more than 8200 SMEs in food and beverage, logistics, construction, agriculture and energy industries.

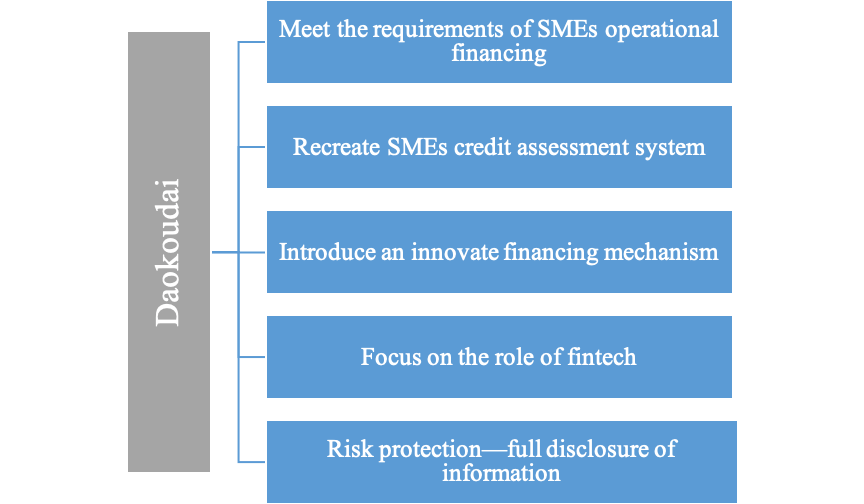

Figure 1 Daokoudai solves financing problems for SMEs

Core values of Daokoudai

Daokoudai is designed to meet SMEs operational financing requirements. Daokoudai provides accurate financial support for SMEs in China, by using fintech tools to raise finance against their receivables. Daokoudai focuses on strict supervision to mitigate risks and deal with conflicts that restrict financial institutions providing credit to SMEs.

With the help of fintech, Daokoudai ensures risk control to protect customer rights and the rights of lenders. Reducing the default cost of SMEs improves the confidence of banks and financial institutions to provide financial supports to SMEs. Daokoudai enables capital from banks to smoothly enter SMEs to form a Monetary Credit Policy Transmission Mechanism.

Daokoudai has established an effective way of credit assessment for SMEs via the digitalisation of traditional credit data including industry analysis, financial data analysis and enterprise credit analysis. This has allowed Daokoudai to build a new credit infrastructure system for SMEs.