With the deep integration of finance and technology, fintech plays increasingly important role in the development of traditional finance industry. As one of the underlying components, alternative data has been rapidly developed and applied in the financial field. Alternative data provides powerful tools for market participants in investment decision-making, risk control, financial regulation and other fields. In order to analyze the application of alternative data, Fintech Lab, THUIFR conducted original research. The research investigated the development of alternative data, alternative data types, the integration of alternative data with the AI field.

Definition and role of alternation data

Alternative data refers to valuable data information that is different from the data in the traditional financial system. These data sets are often used by hedge fund managers, professional investment managers to help financial institutions to make investment as well as help SMEs and individual improve credit rating.

The development of alternation data

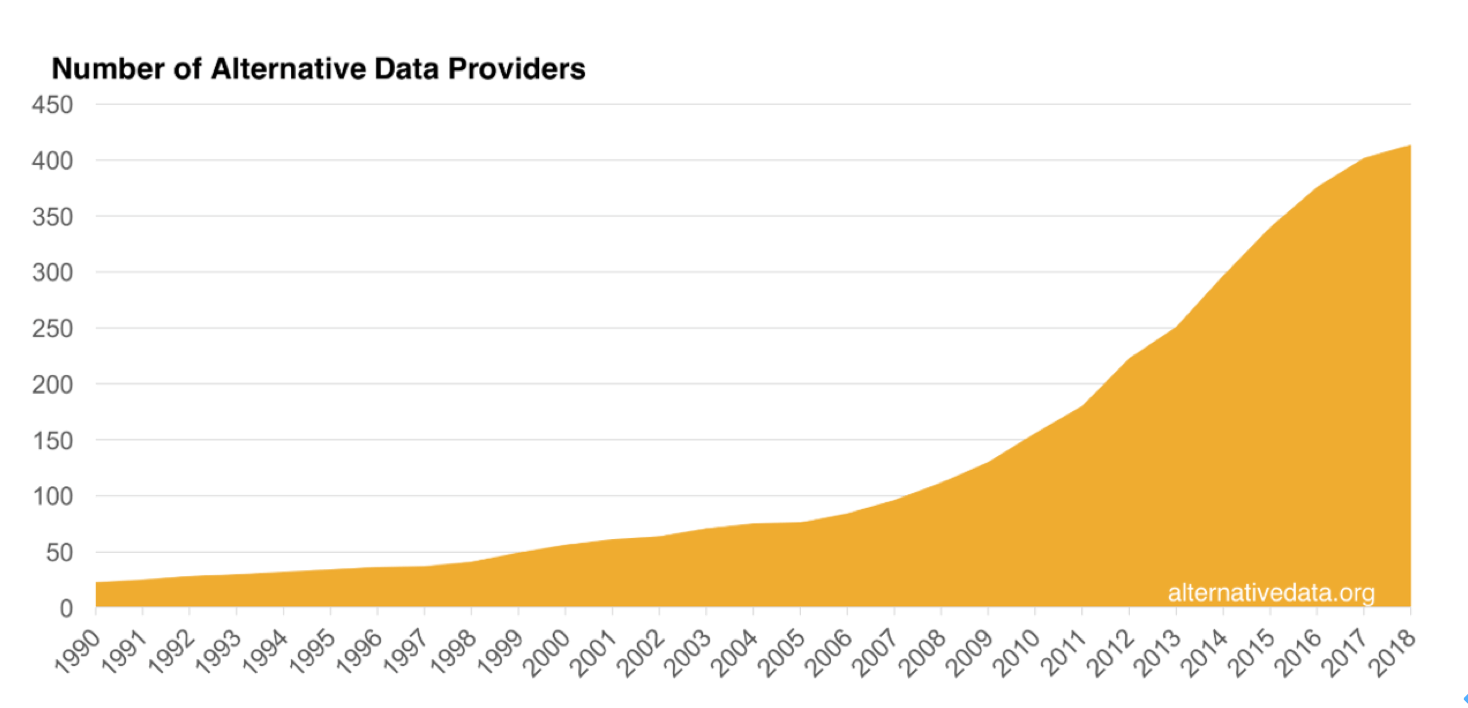

Nowadays, approximately 78 percent of the world’s funds are using alternative data, and mostly web data since it is the most accurate and readily available. According to statistics from AlternativeData (Figure 1), the number of alternative data providers increased from 100 to 400 between 2008 and 2018.

Figure 1 Number of Alternative Data Providers

The classification of alternative data

The application of alternative data in China

Problems with China's alternative data industry

The development environment of the internet industry in China is different compared to that in developed markets. Compared with developed markets overseas, the advantage of China's internet development is the vast scale of mobile internet user data. However, the internet data accumulated by enterprises in China is very scarce, which leads to insufficient firm-level data in China.

The financial industry informatization stage is different in China compared to that in developed markets. For domestic financial institutions, the use of data is concentrated in trading and internal process management, rather than in basic research, risk control and asset management. In comparison the leading foreign investment management firm BlackRock has already built up their Aladdin platform, which relies extensively on external and alternative data integration.

The differences between Chinese and foreign financial market systems are also important reason for the gap in the application of alternative data. Due to the restriction of the trading system, the domestic quantitative investment environment is not yet mature. Meanwhile, due to the strong volatility of the overall market, many investment institutions limit their focus to immediate trading opportunities and tend to neglect the signaling role of alternative data.

An application of the combination of alternative data and AI — intelligent investment research

The development of intelligent investment research in developed foreign markets began earlier than in China. According to public information, intelligent investment and research in foreign countries generally appeared around 2008, while intelligent investment and research in China appeared around 2015. This shows that China is in the early stage of this industry, and there is still a large development space in the future.

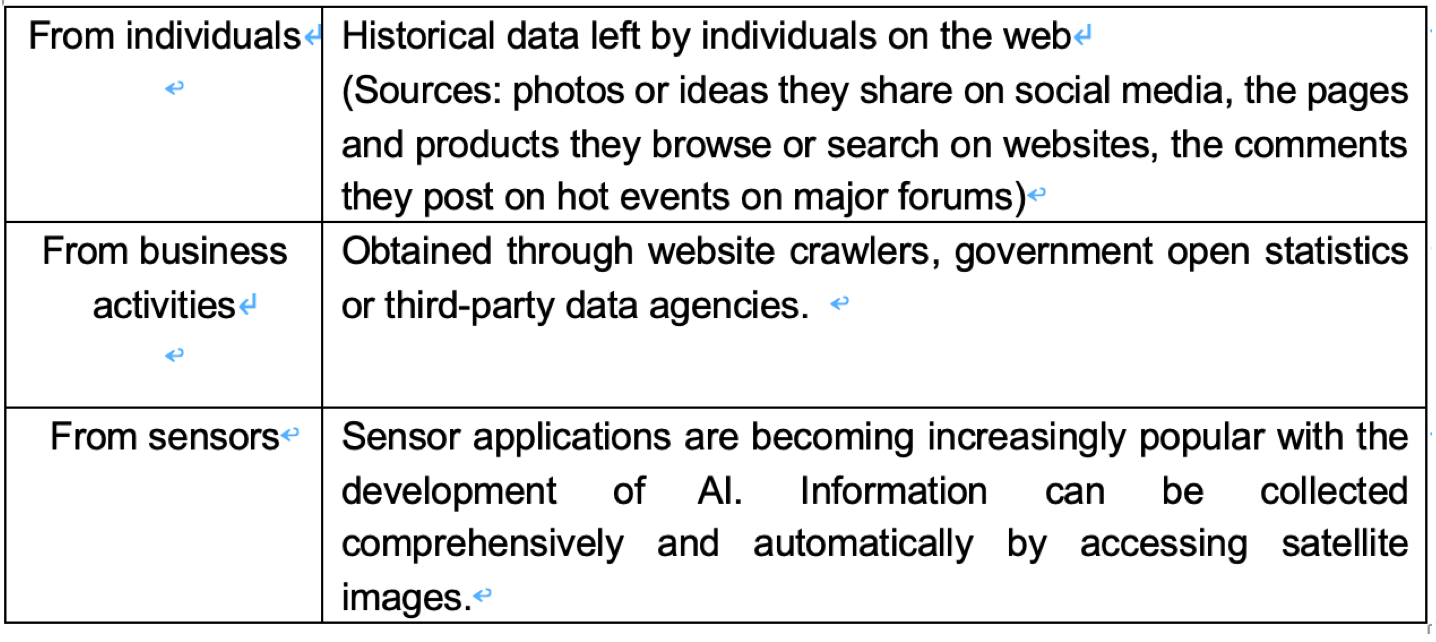

From the perspective of data application types, the alternative data used by the US intelligent investment research institutions has covered almost all categories, from personal data to business process data to sensor data, and the data industry has reached a certain level of scale. Compared with the United States, the development of China's data industry needs to be improved.

Five risks and challenges of alternative data

The following five types of risks should be actively managed:

1) invalid application or wrong guidance.

2) high uncertainty leading to high costs for early recipients

3) data privacy.

4) with the spread of alternative data, alpha is again difficult to find, as additional information is no longer necessarily unique, therefore alternative data is a constantly developing component;

5) regulatory risks and the challenge of how to regulate the large-scale use and dissemination of alternative data remains to be discussed

Prospects for the alternative data industry

The impact of alternative data on investment markets could be profound. As more and more investors adopt alternative data sets, the market can react more quickly. For businesses, they tend to hire people who adapt and learn alternative data sets and methods in the future. Machine learning technologies will become a standard tool for quantitative and some cornerstone investors.

Alternative data is on the rise, and several innovative alternative data companies have emerged at home and abroad, providing new drivers of innovation for traditional financial institutions. It is believed that the application of alternative data in China will play a more important role and bring profound changes to the investment field.