"Know Your Customer" (KYC) refers to the customer identification and verification process applied by financial institutions. The KYC process includes customer identify verification, including background checks to understand the customers, the purpose of the transaction, the actual controller of the account and the beneficiary of the account or transaction. Effective KYC processes detect and prevent suspicious transactions that risk of financial crimes. Sunshine Research Center For Financial Innovation, THUIFR, recently conducted research on KYC. The research aimed to investigate the development of KYC, to analyze current problems and solutions around KYC processes and to provide several suggestions for how these problems can be addressed in the future development of KYC.

The purpose of KYC

The purpose of KYC regulation is to prevent financial institutions being used for financial crimes such as money laundering. KYC regulation requires financial institutions to establish client identity authentication systems. KYC regulation requires that financial institutions understand their customer's identity, background and the details of trading companies and company structures, including the actual controller and actual trade beneficiary. KYC regulation aims to prevent financial crimes and to improve the efficiency of the regulatory and financial system.

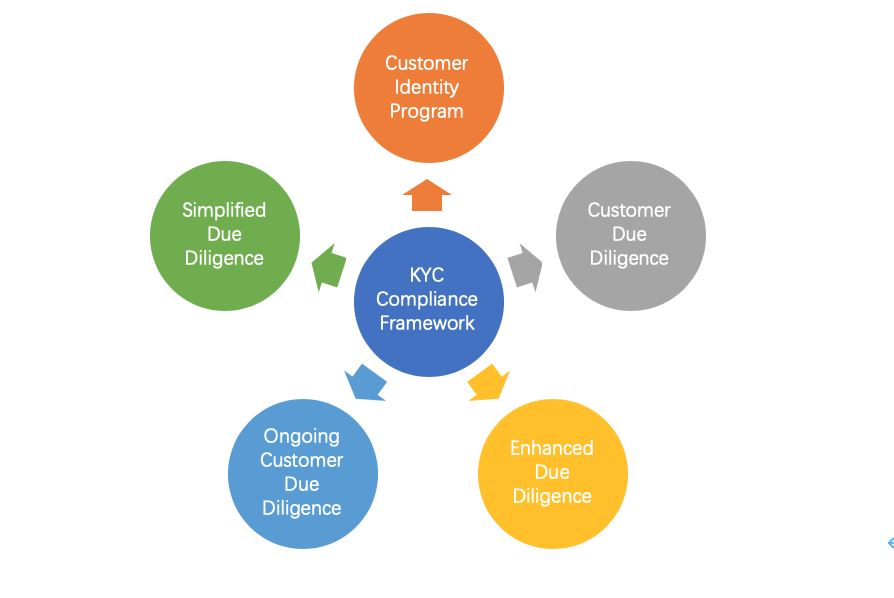

KYC regulatory framework

Problems with KYC

According to a recent Thomson Reuters evaluation report as shown in figure 1, the average KYC compliance process for institutional and corporate clients took about 30 days in 2017, while the average KYC compliance investigation process for non-bank investment companies took 23 days. The global level for both was 26 days, which was two days higher than the previous year’s average. By country comparison, the average compliance time of new clients in Hong Kong, China exceeded 35 days in 2017, while the average compliance time of major countries such as the United States and the United Kingdom exceeded 20 days, and more than half of financial institutions said they expected the compliance time to be longer in the future.

The banking industry spends an average of nearly $70 million a year on KYC compliance, far more than the $23 million spent annually by non-bank investment firms.The majority of financial institutions surveyed spend between $20 million and $100 million annually on compliance, with more than 10% of financial institutions spending more than $100 million annually. Taken together, the average annual compliance cost per financial institution is about $48 million and is growing at an average annual rate of 15% (20% for the banking industry and 13% for investment firms).

The Anti-money Laundering Financial Action Task Force made 40 recommendations for financial institutions KYC compliance in 2012, but according to Thomson Reuters’ survey report, only 37% of the worldwide financial institutions have carried out the suggested changes to their KYC compliance process, 39% of financial institutions said they are still considering the need to change their KYC compliance processes, and have 23% of financial institutions say they will not make any change to their KYC compliance process.

Suggestions for dealing with KYC compliance problems

(1) It is essential for the government to understand the importance of KYC. KYC is important for the sound operation of financial institutions, anti-money laundering and anti-financial crimes, and the improvement of KYC regulation can stabilize the financial market and achieve orderly and healthy development.

(2) A unified KYC regulatory operation system would be established to cover innovative financial businesses other than traditional financial fields, such as P2P and cash lending, so as to help regulators prevent financial risks more rationally and effectively.

(3)Make full use of cutting-edge technology and regulatory convergence to eliminate the phenomenon of the database of isolation between financial institutions as well as improve the efficiency of our KYC compliance process, reduce the error probability, improve accuracy and reduce the time cost of financial institutions.

(4)The government could encourage and supervise technology companies to startup businesses, learn from KYC business models in Europe and the United States, and make independent innovations based on China's local conditions, so as to meet market demand and prevent financial risks.

(5)With the help of KYC regulatory technology, the KYC regulatory system in China would be further integrated with the international standards. This would help local financial institutions to conduct better business in the global market, effectively promote the internationalization of local financial institutions and improve their international competitiveness.